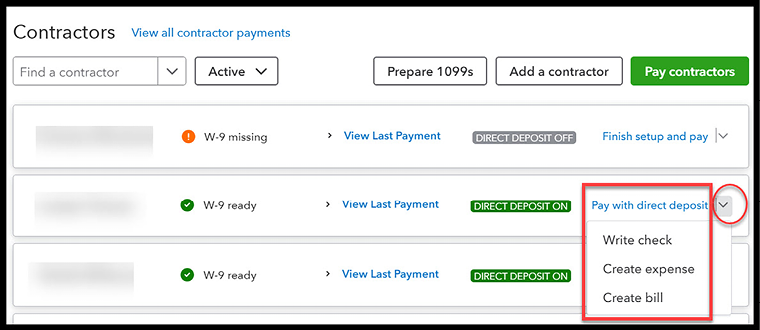

Tracking and paying 1099 contractors

The simplest way to keep track of payments to 1099 vendors is to create an account called Contractor labor expense. This account should be added to your chart of accounts list and used to post all 1099 payments. For more information on adding accounts to the chart of accounts, refer to Chapter 4, Customizing QuickBooks for Your Business.

You can pay 1099 contractors within the Contractors Center. Follow the steps below to set up a payment to a contractor:

- Navigate to the Contractors Center (Payroll | Contractors).

- The following screen will display:

Figure 14.11: Paying contractors within the Contractors Center

- In the far right column, click on the arrow to select the payment method (Pay with direct deposit, Write check, Create expense, or Create bill). Please note that if you would like to pay contractors with direct deposit, you will need to enter their payment details (bank account and bank routing...