Opening balances – VAT/GST/sales tax

If the business using QuickBooks is not VAT registered or similar, then you will not have to enter any opening balances for VAT. However, for a business that files VAT returns, we must consider the following:

- Is the date we start using QuickBooks in line with a new VAT period?

- Is there an overlap? For example, 2 months from the old system and 1 month from the QuickBooks start date will be used to file the next quarter.

- Is there any unpaid VAT from previously filed returns?

- Is VAT filed on a cash basis (dates of payments) or standard accrual basis using the dates of invoices and bills?

In the example within this book, the opening balances have been created for a business that files VAT on a cash basis. The unpaid customer and supplier balances have been entered net plus VAT, and that has resulted in the balance appearing in VAT control.

If all VAT has been paid, and there is no overlap at all, there would be nothing further to do. However, this is going to be unlikely.

Let's look first at VAT already filed but not yet paid. The example here is for a UK company but the principle will work the same in other regions – there will just be different terminology and tax rates.

If the VAT was filed, or about to be filed to March 31, but QuickBooks was only put into use on April 1, there will not be any information held in the software for the quarter January–March to enable us to create a return. However, we can fix that.

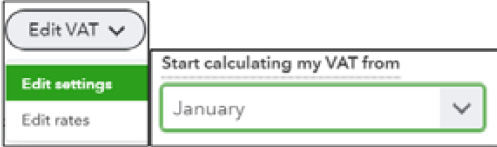

First, check whether the VAT settings reflect the start of the VAT period not filed/paid. So, here we have January selected even though we started using QuickBooks in April.

Figure 1.14 – VAT settings

What we will need to do next is take information from the VAT return that has already been filed, or information from our old accounting system, so that we have the following:

- Summary of sales with a specific tax rate applied and amount of tax

- Summary of purchases with a specific tax rate applied and amount of tax

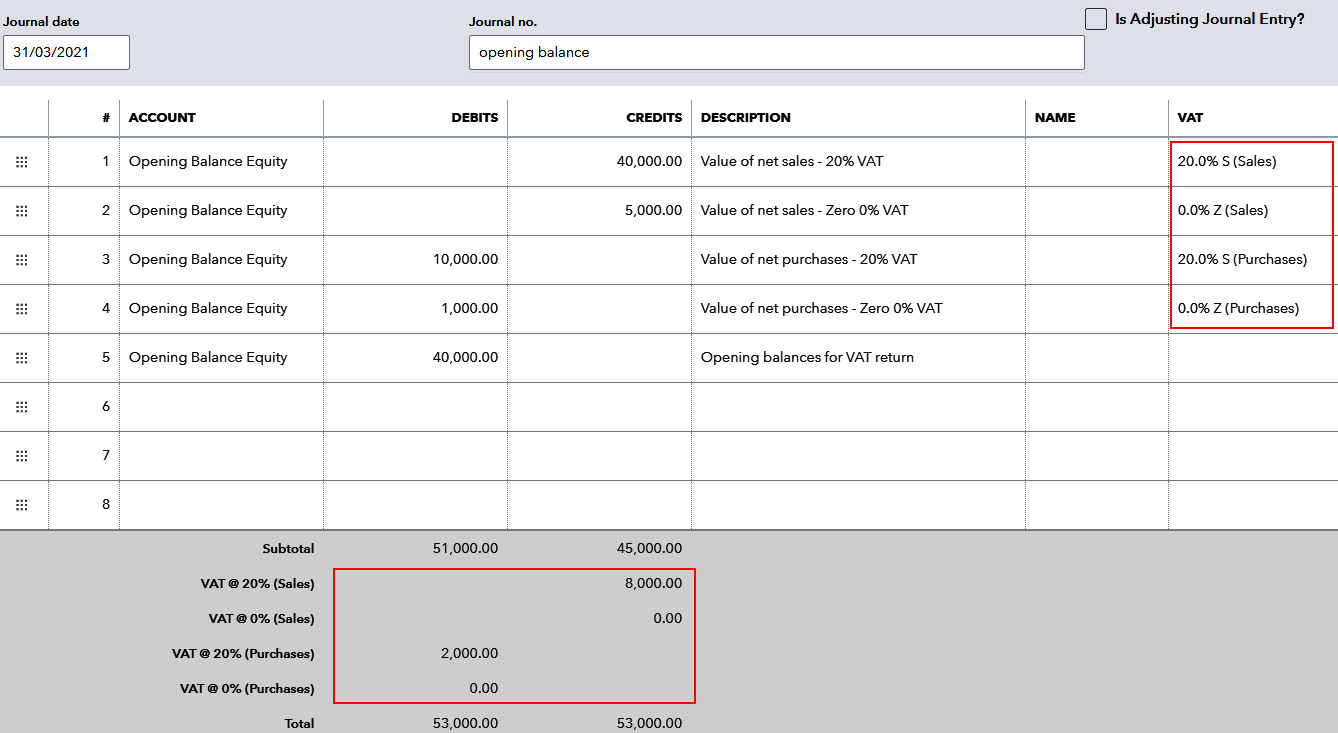

With the preceding information to hand, we will create a journal dated to the last quarter, and this should be entered as shown here.

Figure 1.15 – Journal entry required for VAT balances

Every journal line must be posted to the same account Opening Balance Equity. All values that need to appear on the return must have a VAT rate applied and this will add a VAT value at the bottom of the journal.

The balancing line on this journal is entered into the same chart of account code but does not have a VAT rate applied.

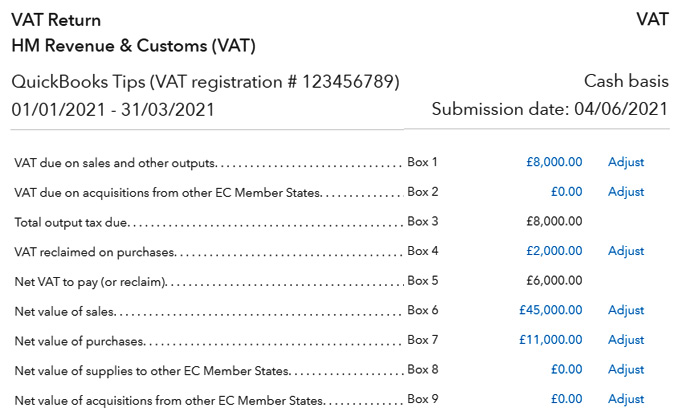

The result of creating the preceding journal will affect our VAT return, as shown in the following figure.

Tip

When creating journals like this, it is possible to attach documents (option available at the bottom left of the journal screen). It is a good idea to attach your spreadsheet workings in case you need to refer to them later.

Figure 1.16 – VAT return summary after the opening balances are updated

We can see that entering a summary of data from a previous period into the journal will populate the VAT return exactly as required. If the VAT return has already been filed with the authorities, it can be manually marked as filed, where the payment can be recorded later.

If you have not filed the VAT return yet for the last quarter, we will now be able to submit the return digitally (if available in your region).

If the business had more than one VAT period unpaid, journals can be created for every period and the VAT returns recreated this way. You must work on the oldest period first, because it would not be possible to create a return for an earlier period once a return has been filed for a later period.

If there was an overlap between the VAT period and the date the business started to use QuickBooks, then a journal could be created that reflects sales and purchases for 2 months from the old system, and sales and purchases from QuickBooks would be used for the third month of the quarter.

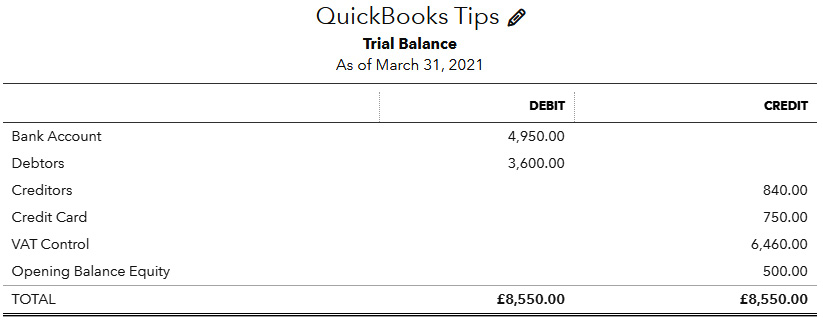

As with all other opening balances, we should check our trial balance to see what the effect of making entries has made.

Figure 1.17 – Trial Balance report after adjustments made for VAT

Creating the journal for the VAT has increased liability in the VAT control account and reduced the Opening Balance Equity account further. When all opening balances have been entered, the Opening Balance Equity account should finally balance to zero.

Let's move on to look at more common opening balances that may be required.