Should opening balances be in place before using QuickBooks?

Before we explore opening balances, we need to know whether it is necessary for our opening balances to be in order when we make the switch from our old method of keeping books to QuickBooks.

The simple answer to this question is no. As soon as you have a subscription in place and set QuickBooks Online up with the required settings, you are likely to want to start creating customer invoices before you do much else.

However, it is best to get some opening balances in place as soon as possible. As customers start to pay for products and services supplied before QuickBooks is in use, it is important to have a record of any of those unpaid amounts in place. This will also be the case when it is time to pay suppliers for amounts owed against historic bills.

We can build our opening balances in stages – it is not necessary to do it all at once. In some instances, it is not possible to deal with all the opening balances because all the information required is not readily available. Therefore, we can put into place the values that are easy to deal with, such as the amounts owed by customers and to suppliers.

What dates are used for opening balances?

Before we answer this question, it is important consider the date you start using QuickBooks Online. You can of course start using QuickBooks at any time, but it can generally make life easier to do so when a clear "line in the sand" has been drawn.

The following are good starting points for a new QuickBooks Online file:

- Any time for a new business (no historical transactions to worry about)

- Start of new financial year/tax year

- Start of new VAT/GST/Sales tax period

Using these starting positions can make life a little easier when preparing financial statements and tax returns. Otherwise, data may need to be merged from two systems, which can increase time consumption and the cost of work required.

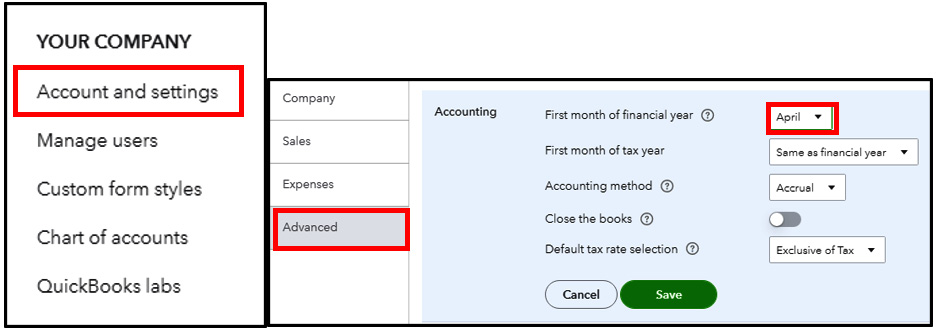

Once you select the start date, ensure the financial year date is set correctly in QuickBooks. To do this, select the gear icon found in the top right of the main screen menus and choose Account and settings from the YOUR COMPANY list.

Figure 1.1 – Selecting the financial period start date

From within the Advanced tab, we select the first month of the financial year. In this example, the year-end is March 31, so the first month is set as April. This company is going to use QuickBooks from April 1, 2021.

Now that we have selected our start date, we will visit some examples of opening balances.